Data undercuts bank attacks

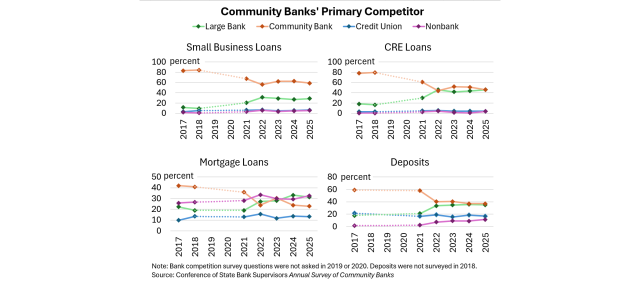

According to new data from the Conference of State Bank Supervisors, community banks overwhelmingly cite large banks and other community banks, not credit unions, as their primary competitors. Yet, despite those findings, some community bank trade groups continue to push the false claim that credit unions are “creeping into their space.”

“It’s the height of hypocrisy,” said Jim Nussle, president/CEO of America’s Credit Unions. “Community banks tell Congress that credit unions are a threat, while telling regulators that they’re not even on their radar. Credit unions don’t compete for profits, they compete for people. They serve Main Street families, small businesses, and rural communities that Wall Street ignores and community banks can’t always reach.”

While others argue over market share, credit unions are focused on helping their members weather the ongoing federal government shutdown. From Maryland to California to Pennsylvania, credit unions are offering paycheck advances, emergency relief loans, and fee waivers for impacted federal employees and military families.

“Shutdowns have real consequences,” Nussle said. “While others debate policy, credit unions are helping members make rent, pay bills, and keep food on the table. That’s what people helping people looks like.”

Bottom Line: As America’s Credit Unions remain united in their mission by serving Main Street families, small businesses and communities, especially during the government shutdown, it’s more important than ever to provide consumers with more options. Bankers’ own data proves their industry’s efforts to stop credit unions from providing more services and helping more people have access to financial options isn’t about facts, it’s about greed.